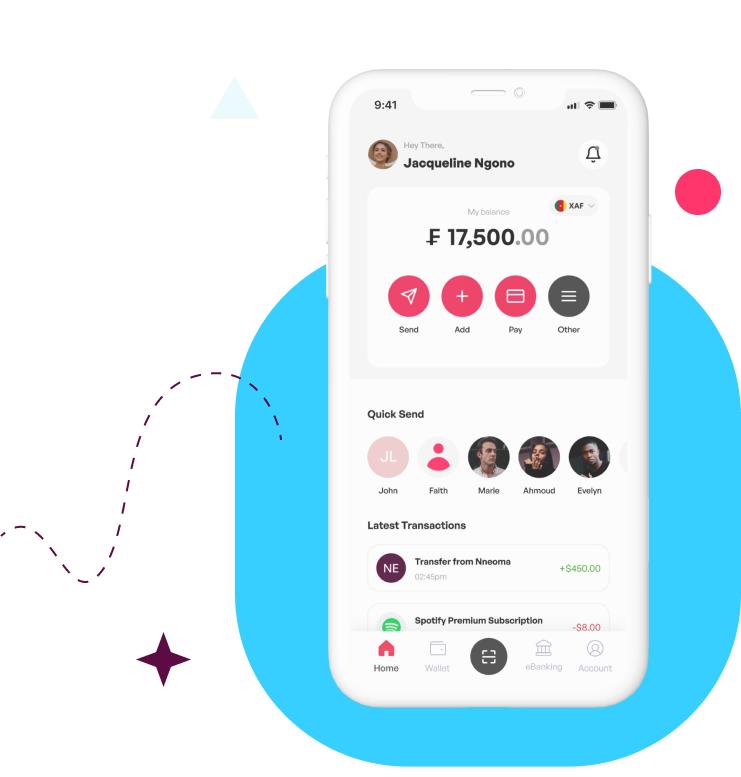

Simplify transactions by Sending & Requesting money

Enjoy digital payments through a smooth & easy user friendly experience & offers secure access to your finances anytime, anywhere.

Explore our digital

Payment options

we provide tailored solutions to meet your digital payment needs. Experience hassle-free transactions with our trusted banking services.

Pay Bills

Discover a world of convenience with our comprehensive payment solutions.

Topup & Withdrawal

There are several convenient options to add money to your account through mobile Money Services such as MoMo , Orange Money, EU money, Yoomee etc,

Invoice

Our Invoice Service provides a simple and efficient way to create, send, and manage invoices for your business.

Money transfer

Our Money transfer services facilitate the movement of funds from one individual or entity to another, often across different locations.

Gift Voucher

A gift voucher service allows customers to purchase vouchers that can be redeemed for products or services from a business. Here are the key points about gift voucher services:

Exchange

A money exchange service, often referred to as a currency exchange, is a licensed business that facilitates the conversion of one currency into another.

Pay Bills

Discover a world of convenience with our comprehensive payment solutions. Whether you're settling bills online, making transfers, or managing recurring payments, our secure platform ensures seamless transactions every time. Enjoy peace of mind knowing your finances are in reliable hands.

Key fe0tures include:

Flexible Payment Options:

Choose between multiple billing services such as Electricity, Water, Data , Internet, TV subscriptions, Government tax, Insurance options.

User-Friendly Interface:

Navigate effortlessly through our online platform and mobile App to set up and manage your payments.

Security:

Your transactions are protected with robust security measures, ensuring peace of mind while handling your financial information.

Timely Reminders:

Receive notifications to help you stay on top of your bills and avoid late fees.

Experience the convenience of managing all your payments in one place, making your financial life simpler and more organized.

Electricity Bill

Recharge

Water Bill

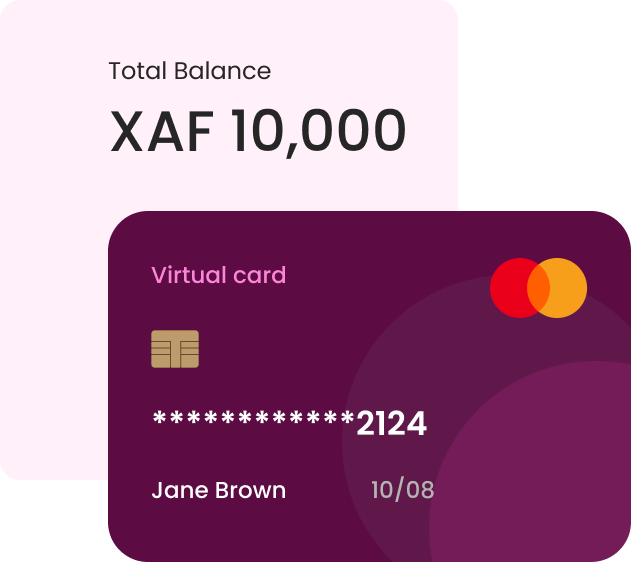

Top-up & Withdrawal

There are several convenient options to add money to your account through mobile Money Services such as MoMo , Orange Money, EU money, Yoomee etc,

MTN Mobile Money (MoMo):

Topup or withdr0w money from your FlexyP0y 0ccount using mobile money service.

Orange Money:

You can also add or withdraw money on your account using Orange's mobile money service,

Express Union Mobile Money:

We also accept Express Union payments.

Yoomee Money:

Yoomee's mobile money service is also on the list.

Wire transfers:

You can wire money directly into your account from your bank or a service like Western Union. Domestic wire transfers are quick but can be expensive.

Checks:

You can deposit personal checks, cashier's checks, or money orders into your account. Cashier's checks clear faster than personal checks.

Cash deposit:

You can deposit cash directly at your bank branch by filling out a deposit slip with your account details and the cash amount.

The best option depends on your specific needs in terms of speed, cost, and convenience. Many banks and mobile money services offer multiple deposit methods to provide flexibility for our customers..

Invoice

Our Invoice Service provides a simple and efficient way to create, send, and manage invoices for your business. Key features include:

Easy Invoice Creation

- Customizable invoice templates

- Add items, quantities, prices, and notes

- Automatically calculate totals and taxes

- Automatically calculate totals and taxes

Secure Online Payments

- Accept credit card and bank transfer payments

- Securely store customer payment information

- Automated payment reminders and receipts

Detailed Reporting

- Track paid, unpaid, and overdue invoices

- Generate sales reports and analytics

- Export data to accounting software

Professional Branding

- Personalize invoices with your logo and colors

- Customize email templates and reminders

- Provide a professional experience for customers

With our Invoice Service, you can streamline your billing process, get paid faster, and focus on growing your business. Sign up today

Money Transfer

Our Money transfer services facilitate the movement of funds from one individual or entity to another, often across different locations. These services can be categorized into several types, including electronic funds transfers, wire transfers, and remittances.

Types of Money Transfer Services

Electronic Funds Transfer (EFT):

This is a broad term that encompasses various cashless payment methods, primarily used for transactions like direct deposits and online bill payments.

Wire Transfers:

These are expedited bank-to-bank transfers that allow for quick movement of funds, often used for international transactions.

Money Orders and Postal Orders:

These are prepaid instruments that can be purchased at post offices and used to send money securely

Remittances:

This refers to money sent by individuals, typically migrant workers, back to their home countries to support family members or for other purposes.

Money transfer services are commonly used for:

- Supporting friends and family, especially those living abroad.

- Making payments for goods and services, particularly in e-commerce.

- Sending gifts or financial assistance during emergencies.

Key Considerations When using money transfer services, individuals should be aware of potential fees, exchange rates, and the security measures in place to protect their transactions.

Gift Voucher

A gift voucher service 0llows customers to purch0se vouchers th0t c0n be redeemed for products or services from 0 business. Here 0re the key points 0bout gift voucher services:

Customers can buy gift vouchers for a specific monetary value or for a particular experience offered by the business.

Gift vouchers are often given as presents to friends, family or colleagues for special occasions like birthdays, holidays, weddings, etc.

Businesses benefit by generating revenue upfront and potentially attracting new customers when recipients redeem the vouchers

Vouchers should clearly state the business name, description of what is included, expiry date, number of users, and redemption instructions.

Terms and conditions are important to specify transferability, refunds, validity period, blackout dates, booking policies, etc.

Accounting for gift vouchers involves recording them as liabilities until redeemed, then recognizing the revenue.

Overall, gift voucher services provide a convenient and thoughtful way for customers to give experiences to their loved ones while helping businesses drive sales and customer acquisition.

Exchange

A money exchange service, often referred to as a currency exchange, is a licensed business that facilitates the conversion of one currency into another. This service is essential for travelers and businesses engaged in international transactions, allowing them to obtain local currency when visiting foreign countries.

How It Works:

Money exchange services operate by buying and selling foreign currencies, typically at physical locations such as airports, banks, and hotels, as well as online platforms. Customers present their home currency, and in return, they receive the equivalent amount in the desired foreign currency based on the current exchange rate. The service charges a fee or adjusts the exchange rate to generate profit, which can result in slightly less favorable rates compared to the market spot rate. Key Features

Locations:

Currency exchanges can be found in various venues, including dedicated exchange booths, banks, and online services.

Fees:

These services often charge a nominal fee or apply a markup on the exchange rate, which can vary significantly between providers.

Exchange Rates:

The rate at which currencies are exchanged fluctuates based on market conditions, influenced by factors such as supply and demand, economic indicators, and geopolitical events.

Money exchange services play a crucial role in international commerce and tourism, enabling the seamless flow of currency necessary for trade and travel. They provide a convenient solution for individuals and businesses needing to navigate different monetary systems while traveling or conducting business abroad.

AGENT SERVICES

An agent solution designed for business-oriented individuals or institutions enables them to facilitate cash-in and cash-out transactions for customers, earning commissions of up to 40%. These agents can operate with various providers, including MTN MoMo, Orange, EU Money, and Yoomee, making it a versatile option for financial services.

Key Features

Commission Structure:

Agents can earn substantial commissions, with rates reaching up to 40% on transactions. This incentivizes agents to engage actively with customers and expand their service offerings

Transaction Services:

Agents are equipped to handle both deposits and withdrawals, providing essential cash management services that cater to the needs of their local communities.

Accessibility:

The agent model offers a convenient alternative to traditional banking, allowing customers to access financial services without the constraints of bank hours or locations. This flexibility can significantly enhance customer satisfaction and loyalty.

Financial Inclusion:

By operating as mobile money agents, individuals and institutions contribute to expanding financial inclusion, particularly in areas where banking infrastructure is limited. This model empowers agents to serve as vital financial intermediaries within their communities.

Overall, this agent solution presents a lucrative business opportunity while simultaneously promoting financial accessibility and inclusion for customers.

MERCHANT SERVICES

Experience Success with Our Merchant Solutions.

Merchant services allow small and medium-sized businesses to accept various payment options, including mobile money services like FlexyPay, MTN momo, Orange money, EU money, and Yoomee money. These services streamline payment processing, improve the customer experience, and help businesses cater to a broader customer base.

Merchant services providers offer a range of services, such as setting up a merchant account, providing access to a payment gateway, and offering tools for tracking transactions and managing chargebacks. They also provide secure payment processing systems that protect sensitive customer data and ensure transactions are processed quickly and accurately.

By accepting mobile money services, small and medium-sized businesses can reach customers who prefer to pay using their mobile devices. This is particularly important in regions where mobile money is widely used as an alternative to traditional banking services.